CAUTION:

Local Banks Can

Kill Your New Dental Office

—————————————————————————————————————————————————-

Discover “The Secret To Business Success”

According To Grandpa Joe

“The inna-come must be betta’ than the outta-go” – the secret to business success according to Grandpa Joe…

“The inna-come must be betta’ than the outta-go” – the secret to business success according to Grandpa Joe…

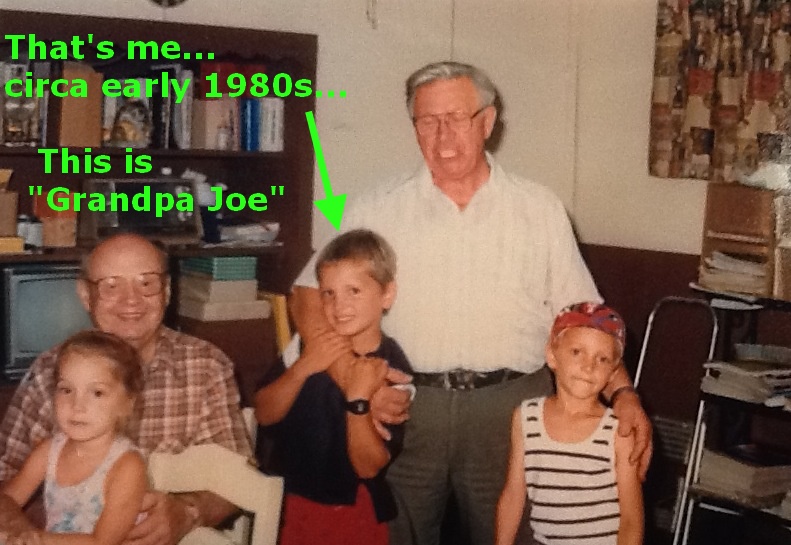

“Grandpa Joe” immigrated from Europe at the turn of the last century. My great grandfather had very few possessions but was rich with love and had a good, thick accent. Being a hardworking man, he even built his family home with his own hands while gathering boxes of nails during the rationing period of the great depression.

I’ll never forget one of his many cheeky, wisdom filled pieces of advice:

The inna-come must be betta’ than the outta-go”.

Grandpa Joe’s words of wisdom are more relevant now than ever!

The 6th topic in our video series on the 7 most overlooked “new office” planning tool is the design of the financing of your new office.

“Learn the Hazards of Good Financing

Versus Bad Financing…and how

the “rate” matters less than you think.”

Dental financing isn’t thrilling, but loan payments are a huge expense for new dental practices – and not everyone knows that dental loans can be designed around your practice needs.

While most people would be more excited about the design of their floorplan than the design of their financing, I can tell you that the financing may be more important than most would believe.

With the wrong loan design, financing cripples a new practice’s cash flow and creates severe stress levels, making practice growth agonizing.

But if you get this right – if you create the right dental financing design – you’ll create better inna-come and minimize your outta-go.

There is a method to doing this right for your new office and I’d like to show you how.

With your financial acumen, you’ll know about unique options available through dental-specific lenders.

You’ll have a strategic plan for:

1) the best tax benefits

2) higher profits

3) lower expenses

4) extremely low payments while you begin to build the new office

5) potential to “wrap in” or “bundle” your old debt

6) your personal credit report (it should NOT show your new debt and I’ll teach you why)

7) your loan structure should be dramatically different from other local businesses

If you get this right, you’ll get all the benefits of the right loan without all the downside that the average small business has to deal with.

Being armed with the right financing knowledge and decisions

will create for you the most-profitable and lowest-stressed new office.

—————————————————————————————————————————————————-

The Crisis In Dental Finance

The typical local banks don’t have what you need.

I won’t make a lot of new friends in the local banking community for saying this but I must be blunt. Local banks are probably great with typical local businesses. Pizza shops. Barber shops. Auto repair shops.

What the typical local bank doesn’t know WILL hurt you.

The bank who says they “do small business loans” will make the process nearly impossible for your long term success.

Too often I hear from doctors who tell me about the terms of the loan they were offered by their local bank and I cringe.

The typical local bank is well intentioned, I’m sure. But they don’t understand the right terms for dentists.

When banks don’t understand an industry intimately, they need to charge more and they’ll make your terms restrictive.

It’s not their fault, really. They just don’t understand.

However there ARE banks who focus on and specialize in working with private practice dentists. And some of them are outstanding.

—————————————————————————————————————————————————-

12 Warning Signs

Here are some warning signs that your typical local bank could be a bad option:

1) They’ll charge you a higher rate

2) they have restrictive terms

3) they ask you to “put up” or “collateralize” your home

4) they ask you to “put up” or “collateralize” other personal assets or trusts

5) they make you pay the entire loan payment the first 6 months

6) length of term is lower than you like

7) they say the entire loan will show up on your credit report

8) they require a sizeable down payment

9) they ask you to have a co-signer

10) too few options of fixed rate or floating rate

11) debt ratio is near 1.5

12) they tell you your “risk profile” isn’t strong

—————————————————————————————————————————————————-

If you can – once and for all – dismiss the comfort with the bank down the street and consider a dental-specific bank, you will be in much, much better financial shape. They may have great checking account rates but for you, for all dentists, I urge you NOT to use your local bank.

I won’t make many friends in the local banking community telling you this but it’s the truth and doctors who work with me find out very quickly about some of the banking horror stories we see out there.

A few doctors have even come to me, asking for suggestions because they’re trapped in bad loans with high interest rates and five-digit prepayment penalties.

Some banks push special start-up business loans, some have government backed loans, others have special healthcare loans. They’re not the right fit for dental practices. Run from those!

—————————————————————————————————————————————————-

Learn More Than Grandpa Joe Ever

Could Have Imagined

About Dental-Specific Loans,

Earning You THE Most.

—————————————————————————————————————————————————-

Are you Ready

To Talk Finances?

There is unquestionably, a right way to structure dental financing.

If you’re ready to talk about options, call me and schedule a time to talk.

We would love to help you get a leg up in this conversation and make sure you’ve got all the right options at your finger tips.

Call or email me now and we’ll schedule a time that works for you.

NEXT:

In just a few days, you’ll receive Element #7 in your inbox.

Are you ready to take some steps forward in opening your new practice?

Get ready – this could be the biggest, most defining year of your career!

Watch for my next email in just a couple of days.

Best,

Jayme

PS: How we can help you create the practice you’ve been dreaming of?

Email me. jayme@HowToOpenADentalOffice.com